How to Choose the Best AI Agent Development Company for Businesses

25+ Disruptive AI Agent Business Ideas You Should Launch in 2025

How to Hire the Best AI Developer for Your Custom Project? Key Steps, Costs, and More

How to Build an AI App? Steps, Features, Costs, Trends

AI in Transportation: Benefits and Use Cases for Modern Enterprises

How to Build an Intelligent AI Model: An Enterprise Guide

The Role of AI in the Oil and Gas Industry – 10 Use Cases, Benefits, Examples

AI in Real Estate: 16 Powerful Applications with Real Examples

AI in the Automotive Industry Transforms the Future of Business: Benefits and Use Cases

A leading digital platform to offer engaging shopping experience to users

A mobile app to digitalise & expand KFC’s digital footprint

The MIT Innovation award-winning app with $52 million funding reshaping the employment landscape.

A transforming ERP solution for the world’s largest furniture retailer

A refined UX strategy for Domino’s to increase their conversion rate by 23%

A SaaS-based financial literacy and smart money management platform for kids

How to Build a Custom Restaurant Management Software? Features, Process, Costs

How Gamification in Banking Helps Enterprises Build Lasting Customer Loyalty

How Much Does It Cost to Build a Car Rental App like Hertz?

How to develop an LLM model? A comprehensive guide for enterprises

How Much Does It Cost to Build a Healthcare App?

How Much Does It Cost to Build an AI Product?

InventivAI by Appinventiv: A New Era of Enterprise AI Innovation

Appinventiv Achieves AWS Advanced Tier Partner Status and Triple Competency Recognition

Appinventiv Leads the Next Wave of AI Innovation for Polish Enterprises

Native vs Progressive Web Apps (PWAs): Who is Winning?

Sprint Retrospective: The What, Why and How

Serverless Vs Microservices – Which Architecture should Businesses Choose?

Flutter Live Event Announcements: Flutter 1.0 Live, Hummingbird, Dart 2.0

Healthcare Workforce Management Software: A Catalyst for Streamlined Business Operations

What is SRM Software and why does it matter to your business?

Key takeaways:

It’s 7:58 AM, and you’re sprinting to catch the morning train, coffee in one hand, phone in the other. Your boss just texted about an urgent client payment, your rent is due tomorrow, and you need to check if your paycheck cleared. No time to visit a bank or boot up a laptop. You pull out your phone, tap an app, and in seconds, you’ve transferred funds, checked your balance, and even locked in a quick investment—all before boarding the train.

This is the power of a well-crafted banking app transforming chaos into control. And that’s why customers are visiting branches less and expect more from mobile devices.

FinTech startups worldwide have already set new expectations for their users. Clean design, fast sign-ups, real-time support, and personalized dashboards are no longer seen as premium features. They are the new norm. Thus, if your banking app falls short, customers won’t hesitate to look elsewhere.

Regulations are also pushing the industry toward better digital infrastructure. Whether it’s open banking frameworks, secure authentication, or evolving compliance guidelines from US regulatory bodies, a safe and scalable banking app is now central to building trust and ensuring long-term sustainability for banks and their subsidiaries.

This blog is your practical guide to mobile banking application development. We will cover the features that matter most, tech stacks that support scale and security, estimated development costs, compliance essentials, and much more. Whether you are planning a new app or upgrading an existing one, this is where to start.

Let’s build you a slick, addictive one that hooks every generation and keeps them loyal.

From paying bills and monitoring credit scores to managing investments and tracking expenses, banking apps have transformed how users interact with their finances, making it faster, easier, and more secure to handle money on the go.

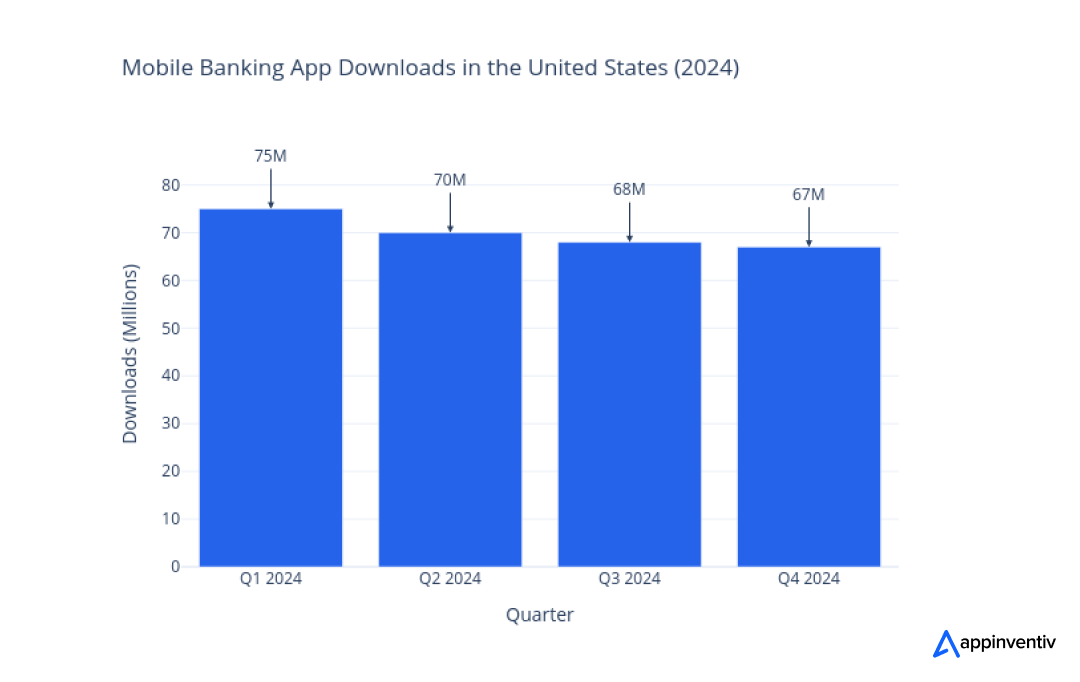

Let’s understand the dominance of mobile banking apps through some impressive figures because numbers don’t lie.

For businesses like yours, these figures make it clear that banking is now a mobile-first approach. Building a powerful, secure, and user-friendly app is not just about keeping up; it’s about staying ahead. It’s about staying ahead, delivering better customer value, and unlocking new growth.

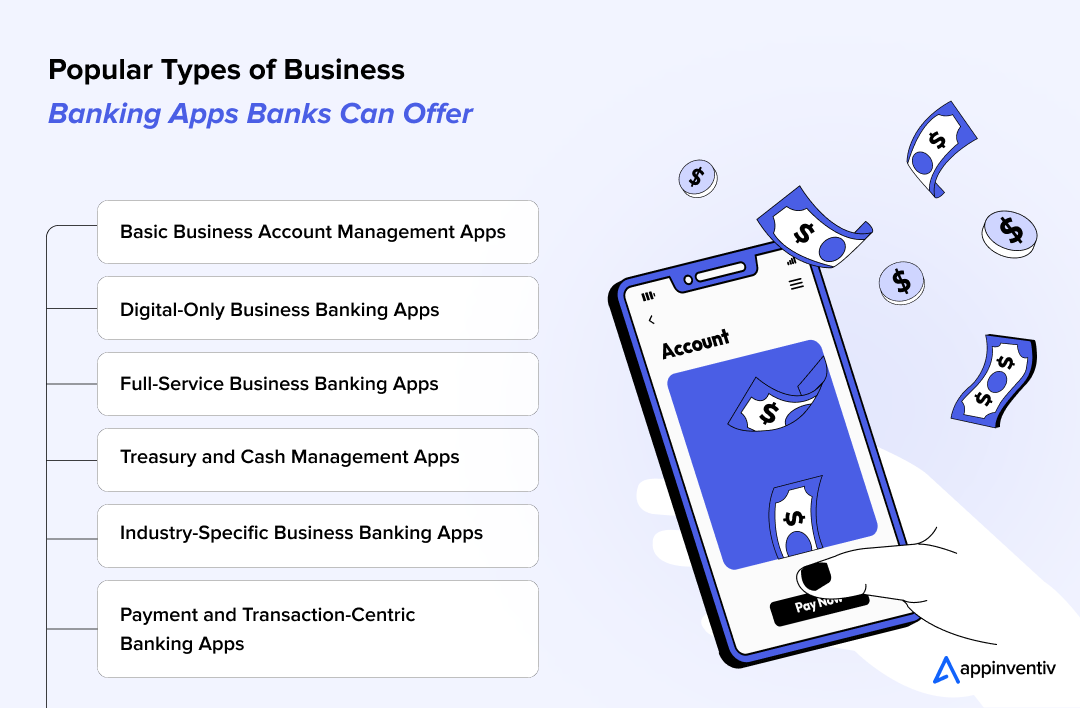

Business banking apps vary in terms of functionality, design, and the specific needs they serve. Given the wide range of services businesses require, several types of business banking apps are tailored to meet the diverse needs of businesses, from small startups to large enterprises. Here are the primary categories of business banking apps:

These apps cater to small businesses, freelancers, and startups that primarily need to manage basic financial functions. The apps typically offer features such as checking account balances, reviewing transaction history, making fund transfers, and providing payment services.

They are designed to simplify everyday banking tasks for small businesses, enabling entrepreneurs to handle their finances on the go without the need for advanced tools.

With the rise of fintech, many digital-first banks have emerged in the financial landscape, offering business banking services exclusively through mobile apps. These apps are designed for businesses that prefer to manage their finances without relying on a traditional brick-and-mortar bank.

Often built for tech-savvy business owners, these types of business banking apps offer a range of features, including business-specific financial tools, quick access to customer support, and integrations with other financial software, all within the app.

Traditional banks cater these apps to mid-sized businesses or enterprises with more complex banking needs who require a more comprehensive suite of services. Full-service banking apps allow companies to manage multiple accounts, facilitate payroll processing, offer credit and loan management system software, and handle cash flow analysis.

Additionally, they may provide reporting and compliance tracking tools, making them suitable for organizations that need a robust banking infrastructure.

These business banking apps focus primarily on facilitating payments for vendors and customers. Businesses in sectors like retail, e-commerce, and hospitality often rely on these apps to handle high-volume transactions efficiently.

Features like point-of-sale (POS) integrations, online payment processing, and automated invoicing are core components of these apps. These apps also streamline customer payments, making it easier to receive funds and issue receipts, thereby improving business cash flow.

Treasury and cash management apps are essential for larger businesses or those with complex financial operations. These apps optimize liquidity, manage cash flow, and oversee investments.

Businesses with multiple revenue streams or extensive accounts payable and receivable may utilize these apps to manage their financial assets better. They often include advanced tools for forecasting, real-time cash position monitoring, and risk management.

Certain industries require digital transformation in banking applications that address their unique financial needs. For example, apps tailored for the construction industry may include features for managing contracts and payments to subcontractors. A few notable applications of business banking apps specifically designed for industries include inventory management, alongside banking functionalities.

Industry-specific apps provide solutions tailored to the operational challenges faced by businesses in sectors such as healthcare, real estate, and agriculture. Mobile banking application development ensures that businesses’ banking requirements are met alongside their industry-specific needs.

From streamlining cash flow management to enabling faster payments, mobile banking apps offer the competitive edge that modern businesses need. Below are some of the key advantages of a business banking app:

Business banking apps offer real-time updates on balances and transactions, providing businesses with instant access to their financial status. This allows quicker decision-making, effective expense tracking, and easier cash flow management.

Bonus Read: ERP in Finance: Bridging the Gap Between Data Challenges and Business Success

The advantages of business banking apps lie in guaranteeing that all financial and banking transactions, such as payments, transfers, and bill settlements, get completed with just a few taps. This digital shift saves valuable time, reducing the need for in-person visits and manual processes.

Banking apps make cash flow management more transparent and predictable by providing tools to monitor incoming and outgoing transactions in real-time. This enables companies to set reminders for upcoming payments, such as bills or payroll, ensuring that no obligations are missed.

Bonus Read: Cash Management Software Development Cost Estimation

Security is a top priority when handling business finances, and business banking apps come equipped with advanced protection mechanisms. One of the remarkable mobile banking app benefits lies in its features that revolve around implementing multi-factor authentication, encryption, and secure login protocols, ensuring that only authorized individuals can access financial data.

Integration with other software tools, such as accounting platforms, customer relationship management systems, and enterprise resource planning systems, helps centralize financial data. This level of integration eliminates the need for double data entry, reduces the risk of errors, and ensures that businesses maintain consistent, accurate records across all platforms.

Bonus Read: CRM in Banking Industry: Benefits, Challenges & Features

Some of the major advantages of mobile banking application development for businesses are accessibility and convenience. Business owners and managers can access their financial data anytime, anywhere. Whether attending a client meeting or traveling for business, the ability to manage finances remotely ensures that operations run smoothly, regardless of geographical constraints.

Dedicated banking apps provide detailed reports, financial forecasting, and insights that support strategic decision-making. This helps businesses optimize their spending, identify areas for growth, and plan for the future. With accurate data, business owners can make informed decisions that align with their long-term objectives, thereby improving both their short-term and long-term financial health.

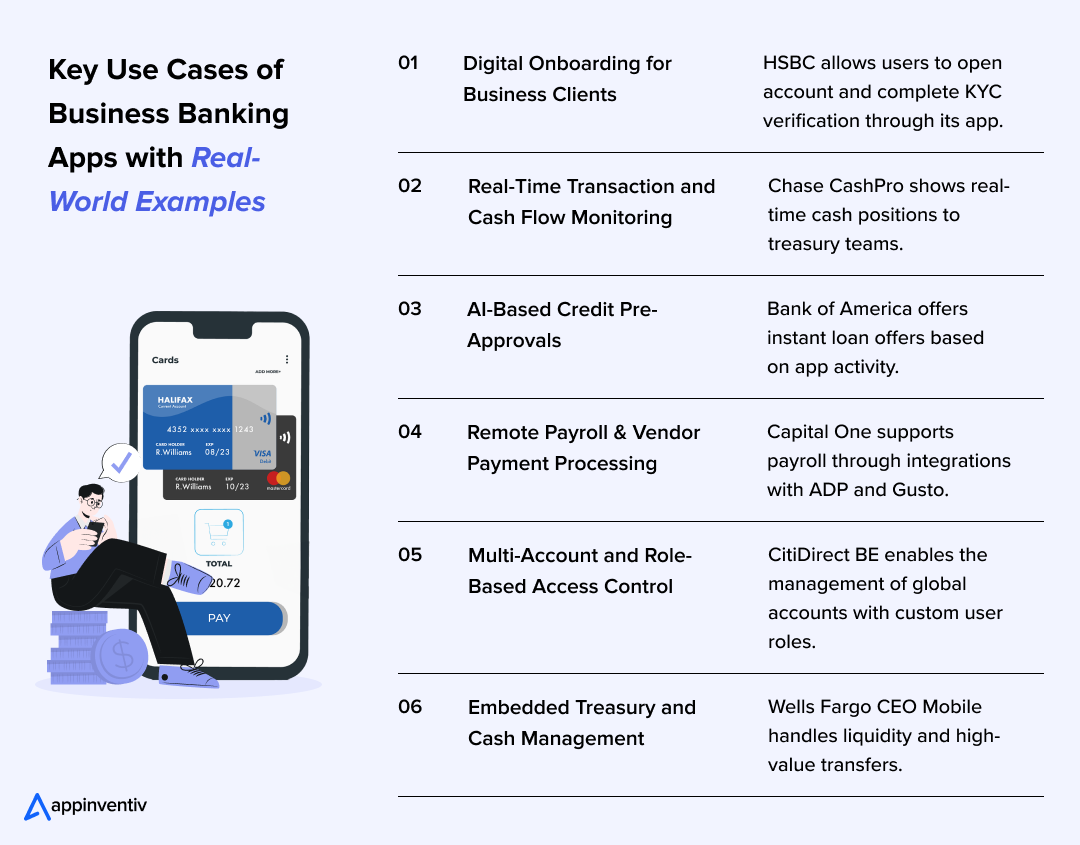

Banking apps are versatile tools that cater to a wide array of use cases, each designed to solve specific challenges companies face in managing their finances. Whether you’re a small business or a large enterprise, mobile banking software development can help you streamline operations, enhance decision-making, and improve financial oversight.

Below are several key applications of the business banking app that highlight how these apps can drive efficiency and success:

The app enables new business clients to open accounts, submit Know Your Customer (KYC) documents, verify their identity, and activate services entirely online, thereby reducing their dependency on in-branch processes.

Real-World Example: HSBC’s business app enables remote onboarding through document uploads, live video Know Your Customer (KYC) verification, and e-signatures, reducing onboarding time to under 24 hours.

The banking app offers dashboards that allow clients to view account activity, pending payments, and real-time balances. This helps banks reduce reliance on manual statements and increases client engagement.

Real-World Example: JPMorgan Chase’s CashPro app gives treasury teams real-time access to cash positions, reducing manual reconciliation across accounts.

Using transaction data, the app can automatically assess creditworthiness and push tailored credit or overdraft offers to eligible business clients.

Real-World Example: Bank of America leverages predictive analytics in its business app to offer pre-approved working capital loans to select clients.

Business apps allow clients to schedule employee payroll, pay suppliers, and approve recurring payments from anywhere, improving cash management workflows.

Real-World Example: Capital One’s delve into mobile banking application development to get a platform that integrates with ADP and Gusto for payroll processing directly through the banking dashboard.

The app enables corporate users to manage multiple accounts and assign role-based permissions to team members, providing activity logs for enhanced visibility.

Example: CitiDirect BE provides large clients with a single dashboard to manage multiple accounts globally, featuring custom user roles and audit trails.

The app serves as a front end for corporate treasury solutions, enabling businesses to schedule liquidity transfers, manage foreign exchange (FX) exposure, and centralize cash positions.

Example: Wells Fargo’s CEO Mobile app enables large businesses to manage liquidity and make high-value transfers directly from mobile devices.

We’ll forge a killer custom-built powerhouse that fits your vibe and leaves your competition eating dust.

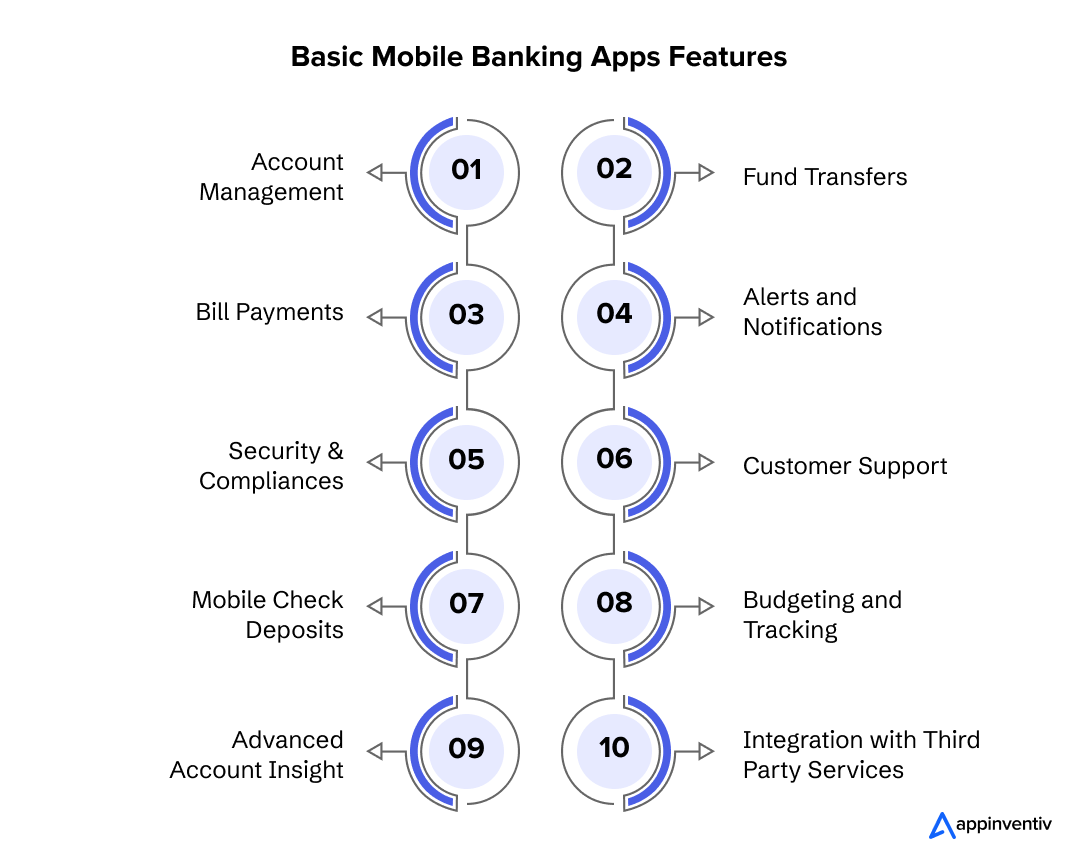

Essential digital banking features form the foundation of a mobile banking app, enabling users to perform everyday banking tasks with ease and security. These core mobile banking features provide a reliable and user-friendly experience, making mobile banking apps indispensable for managing finances on the go.

This feature gives users complete visibility into their bank accounts, including balances, transactions, and statements. It allows users to manage their finances in real-time without visiting a branch, offering full control from their mobile device.

Fund transfer is one of the leading mobile core banking features that lets users send money instantly between their accounts or to others. It simplifies domestic and international transfers with just a few taps, improving convenience and reducing reliance on physical banking.

In-app customer support allows users to access help through live chat, call, or AI-driven chatbots. It ensures that user issues are resolved quickly, enhancing trust and satisfaction with the digital banking experience.

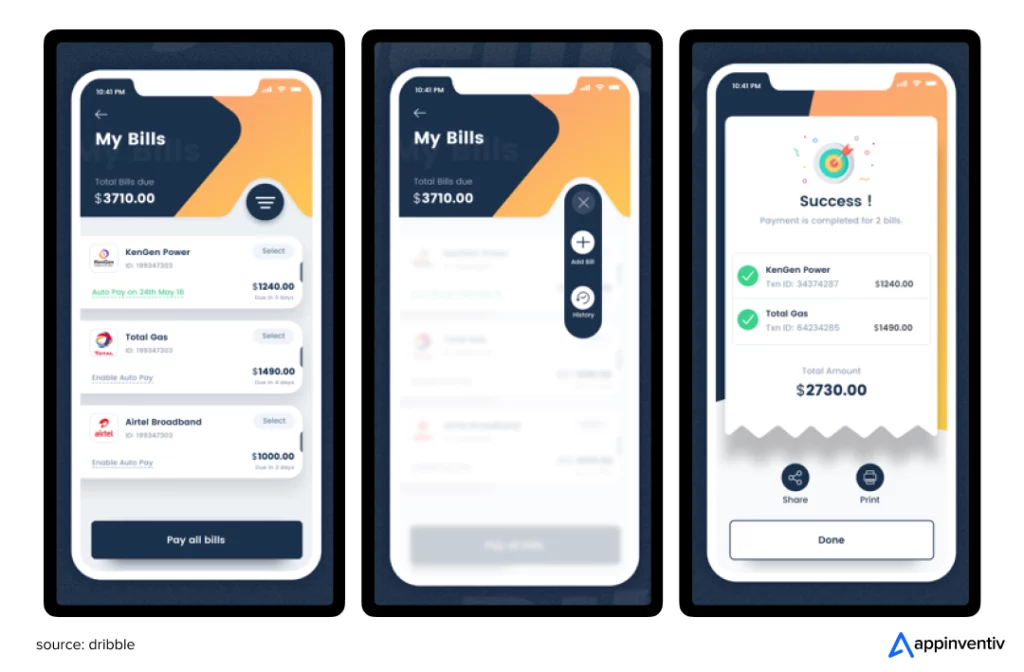

Users can schedule, manage, and pay all their bills within the app. Features like auto-reminders, payment tracking, and receipts reduce missed payments and increase user convenience.

Also Read: A Comprehensive Guide to P2P Payment App Development

Push notifications and real-time alerts keep users updated on transactions, low balances, upcoming bills, and security issues. They enhance app engagement and help users stay on top of their finances effortlessly.

Security and compliance are non-negotiable in banking. Essential security measures, such as biometric techniques, two-factor authentication, and data encryption, protect users’ information from potential theft and threats.

Furthermore, compliance with industry regulations, such as PCI-DSS and GDPR, strengthens this security framework, ensuring that every transaction and data interaction is protected. These mobile banking security features add an extra layer of safety, protecting users from potential fraud by turning their phones into highly secure digital vaults.

Bonus Read: Key IT Compliance Regulations for US Industries

Mobile check deposit has transformed traditional check handling. Instead of visiting a branch, users can snap a photo of their check and submit it via the app. For users with multiple checks or business deposits, these mobile banking features save time and hassle, making them a favorite tool, especially for professionals and busy users who dread waiting in the bank queue.

A budgeting tool goes beyond mere expense tracking; it’s a financial mentor in a user’s pocket that helps analyze spending patterns, set up budget categories, and track progress. This core mobile banking feature empowers users to take control of their financial well-being and stay financially disciplined, all without feeling overwhelmed.

For instance, the tech experts at Appinventiv developed Mudra, an AI-powered financial management app that offers intuitive budgeting tools. This app enables users to gain a clearer perspective on their finances. With its cutting-edge Internet banking features that simplify the budgeting process, Mudra empowers users to take control of their financial well-being and stay disciplined.

This feature of mobile banking applications provides deeper insights into users’ spending habits, cash flow, and potential savings. Users appreciate this feature for its transparency and the way it encourages them to adopt smarter financial habits.

The ability to integrate with third-party services like investment platforms, payment gateways, and tax filing apps transforms a banking app into an all-in-one financial hub. Users appreciate having these services within arm’s reach, as it reduces app-switching and creates a centralized ecosystem where everything they need is just a tap away.

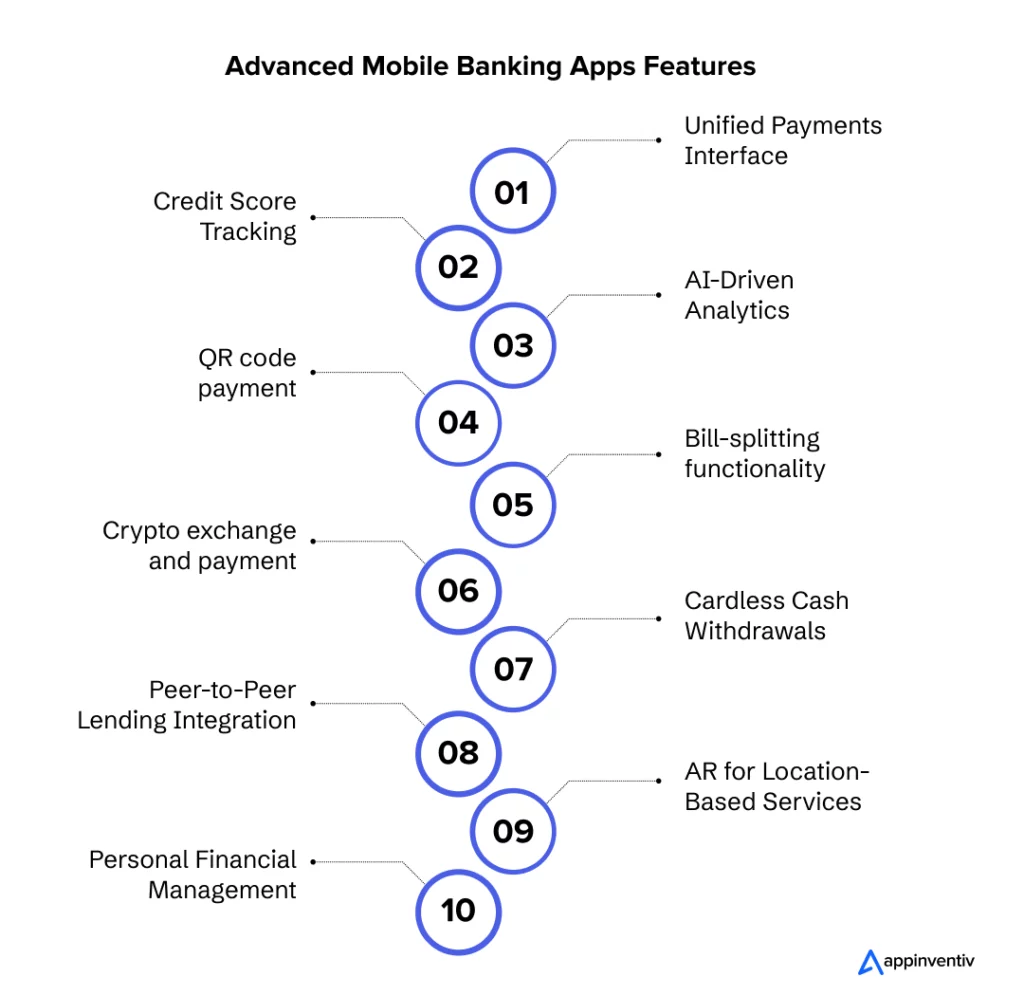

Advanced mobile banking application features go beyond basic functionality, providing users with enhanced security, personalized experiences, and smart financial tools. These features make banking seamless, secure, and tailored to individual needs, setting modern banking apps apart in a competitive market.

UPI works like a digital wallet app, offering a seamless payment platform for instant transactions across bank accounts. By linking accounts through UPI, users can instantly transfer funds, pay bills, and do much more across different banking systems. This feature is especially popular for its speed and ease, eliminating the need to navigate multiple payment gateways.

Also Read: UPI Payment App Development Cost – A Complete Guide

In a world where credit scores can impact everything from loan approvals to job applications, users appreciate the convenience of monitoring and improving their credit. This feature educates users on credit health by providing insights and actionable tips for increasing their scores.

AI-driven analytics take financial insights to the next level, enabling users to see exactly where their money goes and guiding them in optimizing their savings. By using artificial intelligence and machine learning technologies, the feature breaks down monthly and annual trends, highlights unusual expenses, and even predicts future spending. With AI’s ability to detect nuanced behaviors, users receive personalized recommendations, making it easier than ever to make informed financial choices.

QR code payments are one of the best mobile banking app features that have gained traction in today’s digital ecosystem. It adds speed and convenience to everyday transactions. Users can simply scan a merchant’s QR code to make payments instantly. In a world where touchless interactions are gaining popularity, this feature appeals to users for its ease and practicality.

Bill-splitting functionality eliminates the awkward math associated with shared expenses, whether for group dinners or vacations. Users can input a bill, divide it among friends, and even send payment reminders—ideal for the “I’ll pay you back later” crowd.

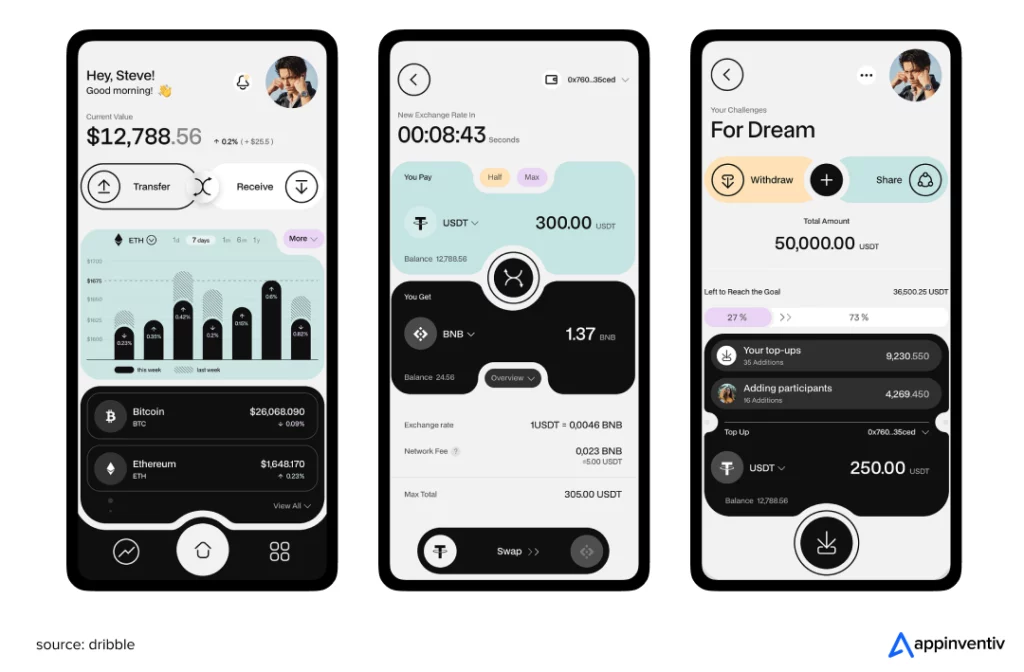

With cryptocurrency gaining momentum worldwide, users are more inclined to trade and spend digital currency. The ability to buy, sell, and pay with crypto in a banking app makes it easy for users to explore this space securely. This feature appeals to tech-savvy users and provides banks with a means to tap into the growing cryptocurrency market.

You may like to know: Cryptocurrency Exchange App Development Cost

With the rise of digital banking, cardless cash withdrawal has become a highly sought-after feature. This allows users to withdraw money from ATMs without needing a physical debit or credit card. Instead, they can authenticate their withdrawal via mobile banking apps using QR codes, PINs, or biometric verification (like fingerprints).

This is one of the most sought-after features that businesses can integrate during mobile banking application development. It connects users with peer-to-peer (P2P) lending networks, allowing them to borrow from or lend to other users directly through the app. By incorporating P2P lending, banks can offer users alternative financing options and potentially higher returns on their savings.

Sometimes, users need nothing but a physical branch or an ATM, and the locator feature makes it easy. Using Augmented Reality (AR) in banking apps, users can locate nearby ATMs, bank branches, or relevant offers by scanning their surroundings with their phone camera. This mobile banking application feature utilizes GPS to enable users to locate nearby physical banking resources or personalized offers.

The PFM feature turns a banking app into a virtual financial advisor. This feature analyzes users’ spending patterns, offers personalized financial advice, and nudges them to spend more vigilantly. It is like having a savvy financial guru by your side.

An example of this in action is the Edfundo app, which promotes financial literacy and money management for young users from an early age. Edfundo empowers users with insights into their spending, budgeting tools, and tailored advice, fostering financial responsibility from a young age.

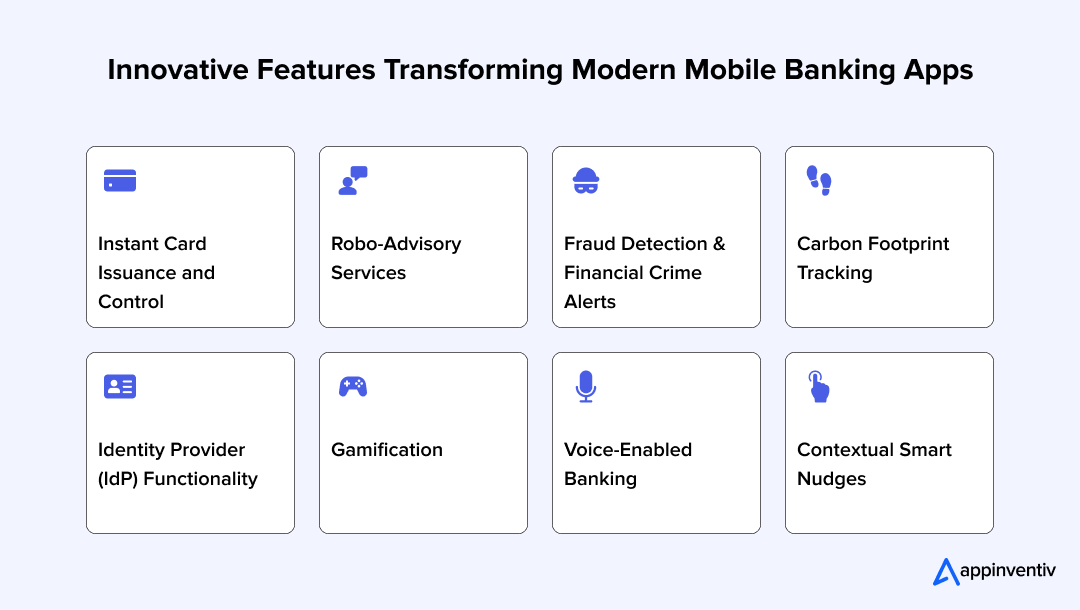

As technology evolves, numerous features emerge, redefining mobile banking app development, particularly for enterprises seeking to provide an enhanced user experience. Here are a few of the best mobile banking app features that are gaining traction in today’s digital BFSI market.

This is one of the most innovative mobile banking features, allowing users to request digital versions of their debit or credit cards instantly within the app. It enables users to manage essential card settings—like spending limits, lock/unlock, and PIN reset—right from their mobile devices. With instant card issuance, users can immediately access digital cards for online transactions, even before their physical cards arrive.

In banking apps, robo-advisors utilize algorithms to provide personalized investment advice, creating portfolios tailored to users’ profiles, goals, and risk tolerance. For businesses, developing a robust robo-advisor platform can elevate their app’s capabilities, offering automated, data-driven advice that makes investing easy and approachable for users who may not have considered it otherwise.

Machine learning algorithms in mobile banking apps analyze transaction data in real-time to detect anomalies, alert users of potential fraud, and safeguard user accounts. This feature adds a layer of security and peace of mind, especially for enterprise-level users who manage substantial financial transactions on the go.

Bonus Read: Financial Fraud Detection Using Machine Learning

With sustainable banking at the forefront, this feature calculates the environmental impact of a user’s spending based on their transactions, providing insights into their carbon footprint and helping them make environmentally conscious decisions. This feature demonstrates a bank’s commitment to social responsibility and attracts users who prioritize eco-friendly banking options.

Since banks already leverage blockchain to carry out KYC (Know Your Customer) processes to verify their customers, mobile banking apps can integrate the features that serve as trusted identity providers. This means customers could use their banking apps for authentication across other services.

For example, if a merchant requires proof of address, the banking app can securely generate and share this information, streamlining the verification process without additional steps.

Who said banking can’t be fun? The gamification features of online and mobile banking incorporate elements such as rewards, points, and milestones into financial activities, making users more engaged in achieving savings goals and transforming financial management into a rewarding journey.

For instance, customers who use the banking app to make a specified number or value of payment transactions within a given timeframe could earn rewards such as points, coupons, or cash back.

Voice technology is becoming a key differentiator in mobile banking. By integrating voice assistants, users can check balances, make payments, or get transaction summaries through simple voice commands. This boosts accessibility and convenience, especially for users who prefer hands-free interactions or are visually impaired.

Instead of generic notifications, smart nudges use AI to provide timely, personalized prompts based on the user’s real-time behavior. This could include nudging users to move idle money into a savings goal, avoid overdraft fees, or take advantage of cashback offers, all driven by contextual triggers.

The mobile banking app development cost depends on two main elements: the total time taken to build the software and the hourly rates of developers.

The time depends on factors including the platforms chosen, the complexity of features, tech stack used, and so on. The hourly rates of developers typically rely on their skills, experience, and location.

Therefore, once you have chosen your development team and figured out the complete app development requirements, you can use this unfailing formula to get a rough cost estimate for your project:

While you can estimate the mobile banking app development cost using the above formula, you can also take a look at the average cost and time it takes to develop apps of different complexity levels in the table below.

Now that you have a clear idea of how to calculate the overall banking app development costs, let us move ahead and discuss the various factors that ultimately determine the price.

As mentioned above, several factors influence the overall cost of mobile application development for the banking sector. Understanding what factors influence the banking app development cost can help you determine your overall banking app budget while at the same time offering you a clear insight into how they play a crucial role in the app’s success.

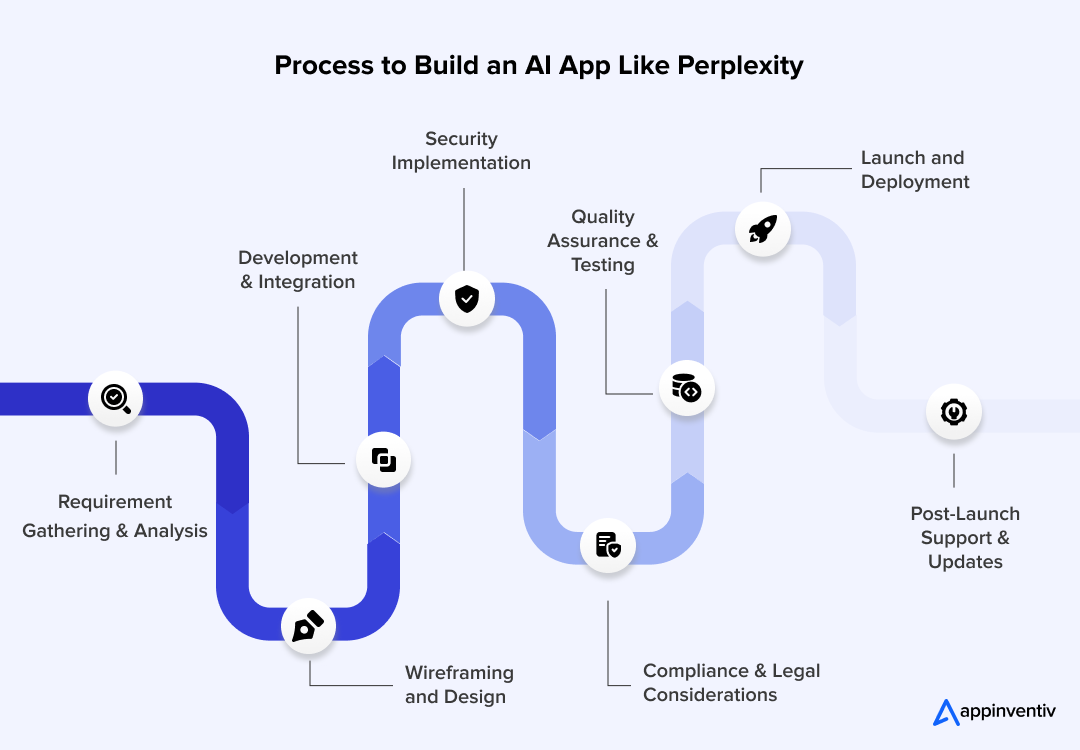

Developing a business banking app involves multiple key stages, all of which are collated to ensure a secure, user-friendly, and efficient tool for business finance management. Below is an overview of those essential business banking mobile app development steps:

This business banking app development lifecycle phase involves collaborating with stakeholders to define the app’s features based on business needs, such as transaction monitoring and payroll management. It also ensures compliance with financial regulations like FINRA and FDIC.

Designing the UI/UX is crucial for ease of use and intuitive navigation. The next phase of the mobile banking app development process is creating wireframes for mobile app designs or prototypes to map out its structure, ensuring it’s simple, visually appealing, and responsive across devices.

This step of banking apps development involves coding the backend and front end, integrating features like payment gateways, and connecting the app with third-party tools like accounting software. It ensures smooth transactions and real-time data updates.

Robust security features, such as encryption, multi-factor authentication, and biometric login, are integrated to protect sensitive financial data and prevent cyber threats.

The app must comply with regulations such as PCI DSS and GDPR. Developers collaborate with legal teams to implement features like encrypted transactions and data audit trails.

Testing ensures that all features function correctly and that the app meets performance, usability, and security standards. This part of the mobile banking app development lifecycle ensures vulnerabilities are addressed before launch.

Once tested, the app is launched on relevant app stores. A staged rollout may be used for initial feedback before wider distribution.

The next part of the business banking app development process is continuous support after launch. This phase addresses issues, ensures compatibility with updates, and releases new features based on user feedback.

So, the stages mentioned above finally conclude the banking apps development process.

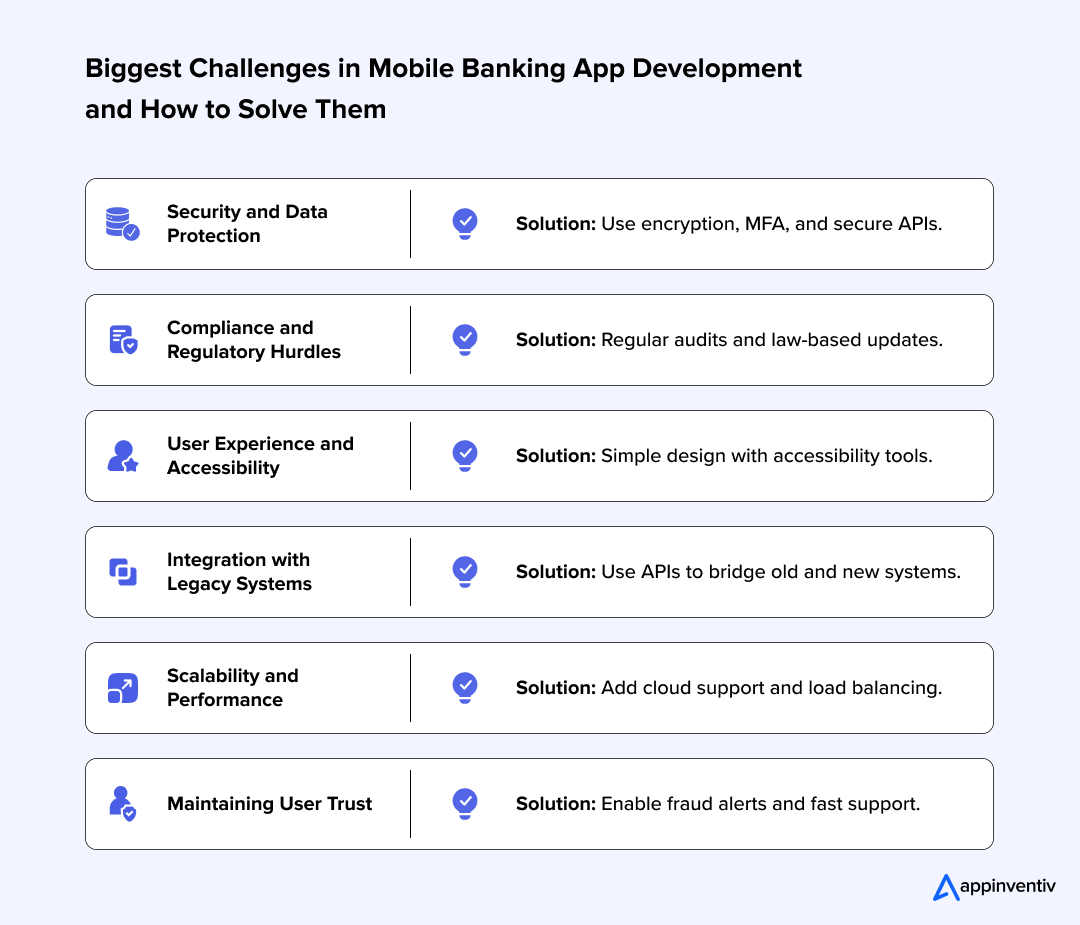

While business banking apps offer immense value to modern enterprises, banks must overcome several significant challenges to deliver a secure, efficient, and user-friendly experience. These challenges can range from regulatory compliance to maintaining user trust. Below are some key hurdles:

Problem

Security measures in mobile banking application development remain one of the most critical challenges in building banking apps. Financial institutions must protect their data from cyber threats, including hacking, phishing attacks, and data breaches.

Solution

This requires implementing advanced security measures, such as:

Addressing these security challenges during banking web application development requires substantial investments in technology and personnel dedicated to monitoring and responding to potential security threats.

Problem

Financial services are heavily regulated, and banking apps must comply with a complex web of local, national, and international regulations. Compliance requirements surrounding mobile banking app architecture and development often vary by region, making it challenging for banks with a global presence to develop a unified solution.

The constant evolution of rules, such as those governing data privacy, anti-money laundering (AML), and Know Your Customer (KYC)—further complicates app development.

[Also Read: AML Software Development – A Detailed Guide for CEOs]

Solution

Banks must continually monitor and update their business banking apps to meet changing compliance standards. This can lead to delays in app releases, frequent updates, and the need for periodic audits to avoid costly fines and penalties. Furthermore, banks must maintain accurate records for auditing purposes, which adds to the operational burden.

Problem

User experience is crucial for the success of any banking app, particularly for business owners and financial managers who rely on these tools for their daily operations. Creating a seamless and intuitive experience can be one of the major challenges in building banking applications, all due to the complex nature of the app’s features.

Solution

The app must provide comprehensive financial data while maintaining ease of use. Users must quickly navigate between multiple sections, such as balance checks, transaction history, payments, and account management. Additionally, ensuring accessibility for all users is an ongoing challenge.

Business banking apps must cater to a diverse user base with varying levels of technical expertise, including individuals with disabilities. Incorporating features such as screen reader compatibility, voice commands, and easy navigation can enhance accessibility and add design complexity. Balancing simplicity with robust functionality is crucial for delivering a positive user experience.

Problem

Many banks still operate on legacy systems that are not designed to integrate with modern technologies, such as mobile apps. This creates significant challenges when integrating a new business banking app with older systems. Whether for payments, account management, or customer relationship management, legacy systems often require extensive customization and upgrades to function with new apps.

Solution

Upgrade the legacy system in banking. Integrating with third-party tools, such as accounting software, enterprise resource planning systems, or customer relationship management platforms, is essential for providing a comprehensive solution. These integrations should be handled seamlessly during mobile banking application development to ensure that data flows smoothly between platforms. It is also vital to understand that technical limitations or incompatibility issues can slow down the integration process and increase development costs.

Problem

As businesses grow, so do their financial needs. Mobile application development for banking businesses must be scaled to accommodate the increasing volume of transactions and the growing number of users. Poor scalability can result in slow app performance, especially during peak transaction periods, which could lead to downtime or a poor user experience.

Solution

Careful planning of the architecture is required when building a banking app to handle a growing user base and large transaction volumes without compromising performance. To address this, cloud-based solutions and load-balancing technologies are often used to scale infrastructure; however, testing the app’s scalability under various conditions is a resource-intensive process that must be carefully planned to avoid performance degradation.

Problem

Businesses depend on banking apps to manage their finances, making trust a paramount concern. A single data breach, system failure, or error in transaction processing can erode user confidence and damage the bank’s reputation, posing one of the most significant challenges in business banking app development. Ensuring that the app operates smoothly, securely, and accurately is critical for maintaining that trust.

Solution

Banks must implement proactive measures to maintain user trust, such as real-time fraud detection systems, transparent communication, and responsive customer support. Offering security features such as fraud alerts, transaction monitoring, and account freeze options can give users greater control over their accounts. Regular security audits and quick resolution of any issues can also help preserve user trust in the long term.

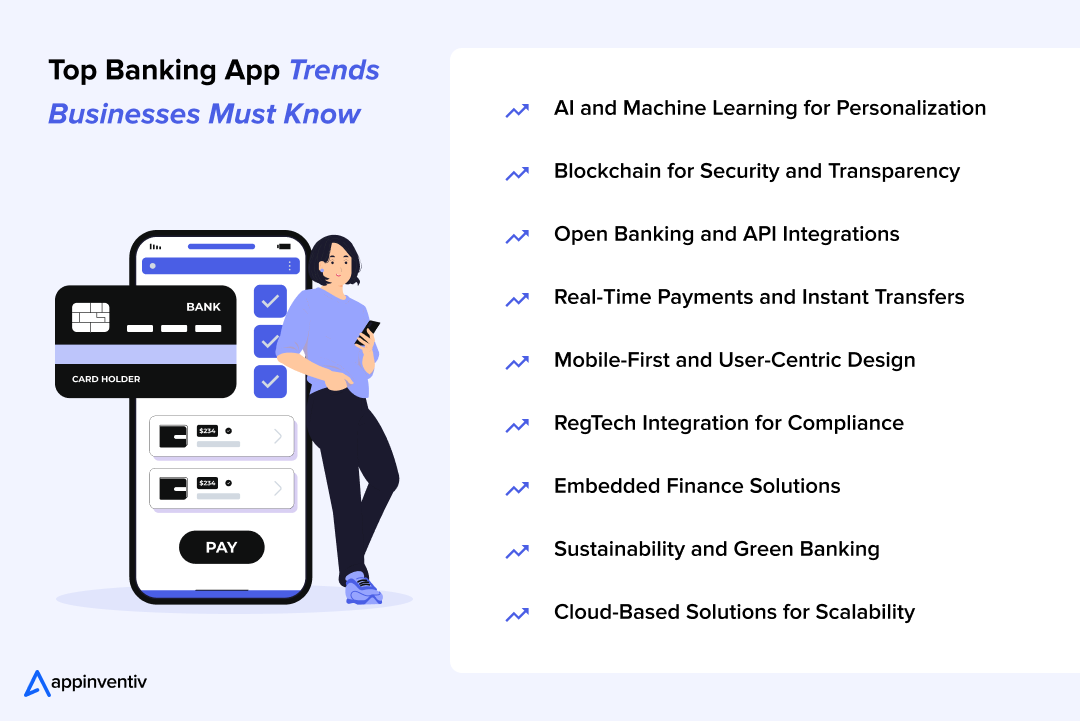

The business banking app landscape is evolving rapidly, driven by technological advancements and changing customer demands. Below are some key trends that will be seen shaping the future of mobile application development for banking businesses:

ML and AI in banking will enhance personalization by analyzing transaction patterns and providing tailored financial advice. Chatbots will become increasingly prominent for offering real-time customer service, while machine learning algorithms detect fraud and predict business needs.

Blockchain technology improves transaction security and transparency by providing an immutable, decentralized ledger. It will be particularly useful for cross-border payments and supply chain finance, ensuring secure and verified transactions.

Open banking enables businesses to share financial data with third-party apps via APIs securely. This integration would simplify financial management by linking banking apps with accounting software and CRM systems.

Real-time payment features enable businesses to make instant payments and transfers, improving cash flow management. Business banking trends around instant payment will become especially beneficial for companies with international operations, reducing the time and cost of cross-border transactions.

When building a banking app, businesses must prioritize a mobile-first design to provide a seamless and user-friendly experience. These apps will be optimized for mobile devices, allowing business owners to access critical financial information.

RegTech tools that automate compliance tasks like KYC and AML monitoring would help businesses meet regulatory requirements while reducing administrative burdens.

Embedded finance would integrate financial services directly into non-financial platforms, such as offering instant loans or insurance within business banking apps. This trend would directly enhance the convenience and expand banking options for businesses.

With the increasing demand for eco-friendly practices, these apps will incorporate sustainability features such as carbon footprint tracking and green investment options as part of the future of commercial banking, thereby helping businesses align with their environmental goals.

[Also Read: Green App Development – The Ultimate Entrepreneur Guide to Building Eco-Friendly Mobile Apps]

Cloud banking platforms offer scalable and cost-effective infrastructures that support business expansion. These applications ensure faster updates, improved performance, and continuous service availability, empowering organizations to grow seamlessly as their needs evolve.

We hope this blog has helped you gain a deeper understanding of the intricacies of mobile banking application development. As a leading custom banking software development firm, Appinventiv is transforming business banking by creating secure, scalable, and highly intuitive apps designed to meet the distinct needs of modern businesses.

Our expertise encompasses the development of advanced features, including multi-user access, real-time financial tracking, AI-powered insights, and seamless integrations with third-party tools. Enhancing efficiency and security ensures that our clients’ business banking apps provide an exceptional user experience while streamlining financial processes.

Being a renowned finance app development company, we understand the critical importance of security and regulatory compliance. Our apps are built to the highest standards, incorporating multi-factor authentication, data encryption, and adherence to essential banking regulations, such as KYC and AML.

With our end-to-end business banking and finance app development services, we help financial institutions create future-ready banking solutions that evolve with business needs.

Ready to elevate your business banking experience? Partner with Appinventiv to bring your vision to life with cutting-edge, secure, and efficient mobile banking solutions.

A. The mobile banking application development process costs can vary from $30,000 to $300,000. Several factors that can further increase or decrease the overall cost of developing a banking app include the app’s complexity, its feature list, UI/UX design, hourly rate of mobile banking app developers, expertise of the app development organization, etc.

A. Designing an MVP for your mobile app can help you reduce the overall budget. The MVP for the banking app can include features like:

Once you have partnered with a dedicated banking app development company and created an MVP, it is time to launch it in the market to get initial feedback. After the MVP has gained traction in the market, you can switch to a fully-fledged mobile application.

A. The latest tech trends that businesses can leverage while building a banking app are mentioned below:

A. Robust banking apps should run smoothly on both iOS and Android, across different screen sizes and devices. Here’s how you can ensure compatibility during the mobile banking software development process:

A. We help businesses build highly secure banking apps that protect user data and meet strict compliance standards. As a leading mobile banking app development services provider, here’s we do it:

A. Banks can integrate AI and ML in their banking apps to offer personalized, intelligent banking experiences to their users. Here’s how you can make it happen:

A. Banks should offer their users actionable insights through smart dashboards and reporting tools. Here’s what they need to include during the mobile banking application development process:

A. Banks that wish to improve engagement and retention must focus on creating value-driven, personalized, and easy-to-use digital experiences. Here’s how they can achieve this:

Peeyush Singh, the Chief Operating Officer at Appinventiv is the man behind optimizing the brand from a 20 people company to 400 people firm. Through his strategic planning, Peeyush has been able to create an ecosystem development formula which prepares teams to efficiently handle all the challenges that are thrown at them. You can pick his brain on this efficient formula that he has created over LinkedIn or Twitter. When found not strategizing and bettering the operations, you will find him exploring the world behind his Nikon lens.

How Gamification in Banking Helps Enterprises Build Lasting Customer Loyalty

Key takeaways: A winning banking gamification strategy isn’t about badges; it’s about using behavioral psychology to form daily financial habits. Industry leaders like DBS Bank and Revolut prove the concept works, driving higher savings and millions in user acquisition. The cost to implement gamification in banking and financial services ranges between $40,000 and $400,000 or…

KYC Automation – Benefits, Use Cases, Steps, Tools and Best Practices

Key takeaways: KYC automation cuts verification from days to minutes and keeps checks consistent across teams. AI and ML reduce manual errors, catch risk earlier, and make compliance far easier to scale. Manual KYC drains time, increases cost, and slows onboarding — automation fixes all three. Automated workflows handle spikes in customer volume without compromising…

How to Modernize Legacy Systems in Banking: Key Strategies and Steps

Key takeaways: Legacy systems burn cash and slow things down, so modernization is essential to stay compliant and competitive. Methods like replatforming, refactoring, or a hybrid approach let banks upgrade piece by piece without breaking everything. Tech trends like cloud computing, AI, and blockchain make modernization happen faster, fixing efficiency, customer service, and safety. Banks…

Digital product consulting, development, and engineering company.

B-25, Sector 58, Noida –

201301,

Delhi-NCR, India

79 Madison Ave,

Manhattan,

NY 10001, USA

96 Cleveland Street,

Stones Corner,

QLD 4120

3rd Floor, 86-90

Paul Street EC2A 4NE

London, UK

Meydan Grand Stand,

6th floor, Meydan road,

Nad AI Sheba, Dubai

Suite 3810, Bankers Hall

West,

888 – 3rd Street Sw,

Calgary Alberta

Appinventiv is the Registered Name of Appinventiv Technologies Pvt. Ltd., a mobile app development company situated in Noida, U.P. India at the street address – B- 25, Sector 58, Noida, U.P. 201301.

All the personal information that you submit on the website – (Name, Email, Phone and Project Details) will not be sold, shared or rented to others. Our sales team or the team of mobile app developers only use this information to send updates about our company and projects or contact you if requested or find it necessary. You may opt out of receiving our communication by dropping us an email on – info@appinventiv.com

1600+ transformation engineers delivered

3000+ game-changing products.

We chose Appinventiv to build our financial literacy and money management app from start to finish. From the first call, we were very impressed with Appinventiv’s professionalism, expertise, and commitment to delivering top-notch results.

It has been a pleasure working with Appinventiv. The team is not only extremely versatile and competent but also very professional, courteous, and responsive. We certainly plan to continue working with Appinventiv for an indefinite period.

We took a big leap of faith with Appinventiv who helped us translate our vision into reality with the perfectly comprehensive Edamama eCommerce solution. We are counting to get Edamama to launch on time and within budget, while rolling out the next phase of the platform with Appinventiv.

I just want to take a moment to thank the entire Appinventiv team for your incredible support. We truly appreciate everything you’ve done, and we’re excited to continue working together as we grow here at KODA

After researching numerous companies, we finally found Appinventiv, and it was the best decision we could have made. They successfully addressed the challenges with our existing app and provided solutions that exceeded our expectations.

We approached Appinventiv with a clear vision to build a robust and future-ready platform that could seamlessly integrate with the busy lifestyle of our customers while uplifting their overall experience and giving us a competitive edge.

Transformation

Engineers Delivered

Game-changing

Products

Connect with our consultation experts to get:

Insights specific to your business needs

Roadmap to overcome your challenges

Opportunities to scale your business in this niche.

To shop authentic smartphones, accessories, and power solutions, visit Thikra Store.

Leave a Comment